A Beginner's Roadmap to Navigating Hard Money Lenders Atlanta Successfully

Wiki Article

Exactly how It Works: A Comprehensive Guide to Hard Cash Loaning

Hard money offering serves as a distinct financing alternative, mainly driven by the worth of actual estate as opposed to customer creditworthiness. This approach attract capitalists seeking fast accessibility to capital for numerous projects. Comprehending the intricacies of tough money loans is necessary for potential debtors. What aspects should one consider before seeking this route? The complying with sections will certainly unravel the subtleties of tough cash financing, offering quality on its effects and functions.What Is Tough Money Financing?

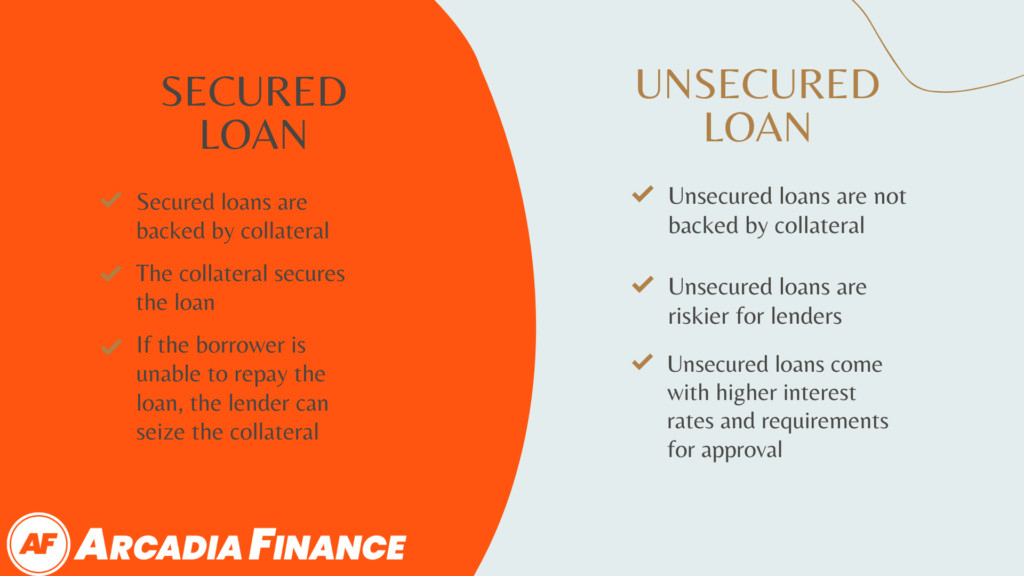

Difficult cash providing describes a kind of financing protected by actual building, usually made use of by consumers that require fast access to resources. Unlike standard lendings, tough money fundings are primarily based on the worth of the collateral instead than the consumer's creditworthiness. This type of financing is often used by property investors, designers, or individuals looking for to get residential properties promptly, specifically in affordable markets.Hard money lenders are normally exclusive capitalists or business that provide short-term fundings, which can vary from a few months to a few years. Passion prices on these loans tend to be greater contrasted to conventional lendings because of the increased risk associated with them. In addition, the authorization procedure for tough money finances is usually quicker, making them an enticing choice for those in immediate monetary situations. Comprehending the basics of hard cash financing is essential for possible customers considering this funding option.Exactly How Hard Cash Loans Function

Understanding how hard cash car loans run is crucial for potential consumers. These car loans are typically short-term funding choices secured by realty. Unlike standard fundings that depend on credit report and earnings confirmation, difficult cash fundings mostly concentrate on the worth of the security building. A lending institution assesses the home's well worth, often needing an assessment, to figure out the car loan amount.Borrowers generally obtain a percent of the home's worth, frequently ranging from 60% to 75%. The funding terms are normally shorter, commonly between one to 3 years, with greater rate of interest reflecting the enhanced risk for loan providers. Payment frameworks might vary, with some finances needing interest-only payments throughout the term, adhered to by a balloon settlement at the end. The speed of financing is a notable attribute, as hard money car loans can often be authorized and disbursed within days, making them appealing for urgent financing requirements.Advantages of Hard Money Financing

While lots of funding options exist, hard money providing offers distinct benefits that can be specifically valuable for actual estate investors and those encountering urgent monetary needs. One considerable advantage is the speed of authorization and financing; customers can frequently secure loans within days, permitting fast deals in competitive markets. In addition, hard money lendings are asset-based, meaning authorization primarily depends upon the worth of the home as opposed to the consumer's credit history. This opens chances for people with less-than-perfect credit report. Additionally, lenders are normally a lot more adaptable in their terms, fitting unique situations and financial investment strategies. Hard money fundings can provide utilize for investors looking to get residential or commercial properties swiftly, allowing them to capitalize on lucrative bargains that traditional funding might not support. This combination of quick accessibility and adaptable terms makes tough cash lending an attractive alternative for several in the actual estate sector.Risks Connected With Difficult Money Fundings

Difficult cash finances existing numerous inherent threats that borrowers must take into consideration. High interest rates can considerably enhance the general expense of borrowing, while brief loan terms might put pressure on repayment timelines. These elements can create monetary strain, making it vital for potential debtors to analyze their capacity to take care of such difficulties.

High Rates Of Interest

High rate of interest represent a substantial danger aspect in the domain name of difficult money fundings. These loans commonly attract consumers that may not get approved for standard funding, causing higher prices that can range from 8% to 15% or more. This elevated cost can strain the borrower's monetary circumstance, particularly if the finance is not protected with a feasible exit technique. The pressure of high repayments can result in default, endangering the borrower's home and investment. Rate of interest rates can rise and fall based on market conditions or loan provider plans, including uncertainty to the debtor's repayment responsibilities. Consequently, understanding and planning for these high interest prices is important for any individual thinking about hard cash offering as a funding option.

Brief Lending Terms

Brief financing terms are a defining attribute of difficult cash loans, usually ranging from a few months to here are the findings a couple of years. This brevity can posture considerable risks for consumers. The restricted timeframe might push consumers to promptly market the security or refinance, possibly causing financial strain if market problems are unfavorable. Furthermore, the short duration can lead to higher regular monthly repayments, which might surpass the debtor's capital abilities. Customers risk losing their investment if unable to meet these responsibilities. The necessity to act can lead to hasty choices, compounding the possibility for economic bad moves. Recognizing these risks is essential for anybody considering tough cash financings, making certain notified selections are made in the financing process.Secret Factors To Consider for Debtors

When thinking about tough cash lendings, borrowers must assess numerous essential aspects. Rates of interest, funding terms, and collateral requirements play critical roles in establishing the general usefulness of the finance. Comprehending these facets can greatly influence a borrower's decision-making process and economic results.

Rate Of Interest Prices Influence

Recognizing the impact of rates of interest is necessary for borrowers taking into consideration difficult cash lendings, as these rates can considerably influence total funding costs. Commonly, tough cash financings include greater rates of interest contrasted to conventional funding, showing the boosted risk taken by loan providers. If the greater costs line up with their financial investment strategies, debtors must meticulously evaluate their monetary circumstance and task returns to figure out. In addition, fluctuating market conditions can better impact interest rates, making it vital to secure a lending when rates agree with. Debtors need to additionally consider the duration of the finance and settlement capabilities, as these variables can considerably impact the complete amount paid with time. Inevitably, recognition of rate of interest price implications is crucial for informed loaning decisions.Funding Terms Clarified

Car loan terms play a necessary role in shaping the total experience of customers seeking hard money financing. These terms commonly consist of the funding amount, payment duration, and interest prices, which are essential for customers to examine their monetary responsibilities. Hard cash loans frequently include much shorter payment periods compared to traditional loans, typically ranging from 6 months to three years. Customers need to additionally consider the associated costs, which can differ in between lenders and may affect the complete cost of loaning. Understanding these terms assists customers make educated decisions and analyze their ability to repay the car loan (Hard Money Lenders Atlanta). Eventually, clear understanding of the lending terms can considerably influence the success of a tough money offering dealCollateral Needs Overview

Collateral needs are a crucial facet of difficult cash providing that borrowers need to carefully take into consideration. Usually, tough cash loans are protected by genuine estate, and lenders expect the property to have a substantial worth about the financing quantity. This collateral acts as a safeguard for lenders, enabling them to recuperate losses in situation of default. Borrowers ought to know that the problem and location of the residential or commercial property greatly influence collateral worth. Furthermore, loan providers might require a building appraisal to assess market well worth. Recognizing these needs is crucial, as not enough security can cause greater rate of interest or denial of the financing. Inevitably, consumers should identify they can meet collateral expectations to secure see here now desirable financing terms.The Application Process for Hard Cash Loans

How does one browse the application procedure for difficult cash car loans? The procedure generally begins with a debtor recognizing an appropriate loan provider. After selecting a loan provider, the consumer sends an application, which generally includes individual info, information regarding the residential or commercial property in inquiry, and the meant use the car loan. Unlike conventional financings, hard cash lending institutions concentrate much more on the value of the security as opposed to the customer's creditworthiness.Once the application is obtained, the loan provider performs an evaluation of the residential property to determine its worth. This action is crucial, as it influences the car loan amount offered. If the evaluation meets the lender's requirements, they continue with the underwriting procedure, which is normally expedited contrasted to conventional lending institutions. Upon authorization, the debtor obtains a car loan quote, detailing terms and problems. Lastly, after accepting the terms, the customer indicators the necessary documents, and funds are disbursed quickly, generally within days.Frequently Asked Questions

Can Hard Money Loans Be Used for Personal Expenses?

What Kinds of Quality Get Approved For Hard Money Loans?

Numerous home types certify for difficult money financings, including property homes, business structures, land, and investment residential properties - Hard Money Lenders Atlanta. Lenders usually think about the home's value and potential commercial instead of the consumer's credit reliabilityHow Swiftly Can I Receive Funds From a Difficult Cash Lender?

The speed at which funds can be gotten from a difficult cash lending institution typically ranges from a couple of days to a week, depending upon the loan provider's procedures and the residential or commercial property's evaluation. Quick access is a crucial benefit.click to read more

Are Difficult Money Loans Regulated by the Government?

Difficult cash finances are not greatly managed by the federal government, unlike typical finances. Lenders usually operate individually, causing varying problems and terms. Debtors need to look into particular lending institutions to comprehend their practices and compliance.Can I Re-finance a Tough Money Funding Later On?

Re-financing a tough cash funding is possible, depending on the loan provider's policies and the debtor's monetary scenario. Usually, customers seek traditional financing choices after demonstrating boosted credit reliability and residential property value appreciation. Unlike typical lendings, hard cash lendings are primarily based on the worth of the security instead than the debtor's credit reliability. Unlike traditional lendings that count on credit report scores and earnings confirmation, hard money financings mainly concentrate on the worth of the security residential property. Short financing terms are a specifying attribute of difficult money financings, typically ranging from a couple of months to a couple of years (Hard Money Lenders Atlanta). Hard cash financings typically include shorter repayment durations compared to typical financings, generally varying from 6 months to three years. Generally, tough money financings are protected by actual estate, and loan providers anticipate the residential property to have a significant worth loved one to the financing quantityReport this wiki page